RTG Ventures, Inc. (OTCBB: RTVG), Part I – Mind Games

[First published on 11 December 2003 on the website www.stockpatrol.com]

Investors in the United States face a fundamental problem when it comes to assessing businesses that claim to be centered in the Peoples Republic of China. China is not noted for an open door policy when it comes to the flow of information. Consequently, verifiable facts are relatively scarce. Throw in language barriers, currency conversions, and a cultural communications gap, and investors all too often find themselves up against a Great Wall.

Often, the only news to emerge from this miasma comes from the company itself or from paid promoters who rarely point out investment risks. They urge the public to trust their advice and recommendations, though they have done little to earn such a leap of financial faith.

Which brings us to a profile that recently arrived in our fax machine touting an OTC Bulletin Board company called RTG Ventures, Inc. (OTCBB: RTGV). The fax, from a promoter called Stock Alerts, LLC, described RTG as a “multimedia gaming company” whose relationships in China created an “incredible buying opportunity right now.”

Before we get too carried away, however, there are a few questions that need to be answered. More than a few, actually, starting with this – what is the current business and financial condition of RTG? Not surprisingly, these are issues that Stock Alerts has elected to ignore. Seeking further details from Stock Alerts seems impossible. Like most promoters who distribute such faxed “profiles,” Stock Alerts does not provide its address or telephone number (although they do include a phone number for anyone who wants to be removed from their database).

What’s the story with RTG Ventures? We decided to take a look for ourselves.

BRAIN GAMES

Like a growing number of OTC Bulletin Board companies, RTG Ventures is the product of a reverse-merger between a struggling public shell and an obscure private company. According to a Form 8-K filed on June 6, 2003, the Company entered into agreements to acquire all of the outstanding stock of MJWC, a British Virgin Islands corporation, and all of the assets of Brain Games Asia, Inc., also a British Virgin Islands corporation, on May 21, 2003.

RTG Ventures has not yet filed copies of those agreements with the Securities and Exchange Commission, although the June 6th Form 8-K (filed over six months ago) promised that they would be “filed by amendment.” Consequently, details of the transactions – and the parties involved – are sparse. The June 6th Form 8-K states that the Company issued a total of 26,475,000 shares of its common stock in connection with the two agreements. It does not specify who received those shares, other than to say that, at the conclusion of the deals, “the shareholders of Brain Games Asia, Inc. and MJWC control approximately 84% of the issued and outstanding shares of the Company’s common stock.”

Who are those shareholders? RTG Ventures did not provide that information, although it noted that Fraser International Holdings, Inc., another British Virgin Islands company, is the beneficial owner of approximately 65% of the outstanding common stock of the Company. Who controls Fraser International Holdings? Once again, the Form 8-K was silent.

Considering the Company’s financial state at the time of these acquisitions, shareholders might not have been immediately troubled by the lack of details. As of February 28, 2003, RTG Ventures had just $59 in its bank account. The Company, which at the time was in the business of importing crawfish from Indonesia, was not generating any income as of February 28, 2003. The lack of revenues, the Company claimed, could be traced to the international climate that followed the terrorist attacks of September 11, 2001. The broker who had been securing purchases of crawfish for RTG in the Far East had declined to travel after the attacks.

Faced with this sorry financial situation, the Company elected to turn over control to those unidentified shareholders of MJWC and Brain Games Asia. Neither of those companies were in the crawfish business, but both were centered in the Pacific. According to the June 6th Form 8-K, MJWC had a “contract with Chinese Sports Ministry to organize and promote the world Chinese Poker Championships until 2009,” and owned “all the multimedia and Internet rights to the championships and the events leading up to it.” It also had contracts to “to organize and promote the world Mah Jong Championship until the games 2009.” The Company also claimed that these contracts afforded MJWC access to “a database containing in excess of 30 million online players of the above games.”

What were “the games 2009?” Was the Company referring to the Summer Olympics? Perhaps, but the Summer Olympics are scheduled to be held in China in 2008 – not 2009 – and the Form 8-K never refers specifically to the Summer Olympic Games.

The sole asset of the Company’s other new acquisition, Brain Games Asia, was the right to organize and promote the Chinese Chess championships.

It is not clear how the Company plans to organize, promote and market these various gaming tournaments. Funding would seem to be a significant prerequisite. The June 6th Form 8-K did not include any financial information for the newly acquired businesses, but promised that it would be filed within sixty days. On August 22, 2003, RTG Ventures filed another Form 8-K, this time including financial statements for MJWC and Brain Games Asia. The picture was not particularly promising.

As of April 30, 2003, MJWC had no assets – as in zero. MJWC had no operating business and, consequently, had generated no revenues. While it had no operations, MJWC maintained that, in April 2003, it had acquired from the Chinese government the contractual rights to organize and promote the world class Chinese Poker Championship and the world Mah Jong Championship.

How much did MJWC pay for these precious rights? Nothing, which certainly suggests that the Chinese government did not consider them terribly valuable.

Neither RTG Ventures nor MJWC has provided any details of these agreements with the “Chinese government,” or any documents reflecting the nature and extent of those rights. MJWC’s financial statements claimed that management planned to “commence operations and exit the development stage in the later part of 2003.” With only a few weeks remaining in 2003, there is no sign that revenue producing operations are underway.

The August 22nd Form 8-K included no separate financial information attributable to the acquired assets of Brain Games Asia.

One more thing. The Company has not filed a Form 10-Q since May 26, 2003.

So why are the touts at “Stock Alerts” urging investors to buy shares of RTG Ventures “right now.”

We will explore that question in Part II of this report.

RTG Ventures, Inc. (OTCBB: RTVG), Part II – Playing Games

[First published on 12 December 2003 on the website www.stockpatrol.com]

RTG Ventures, Inc. (OTCBB: RTVG) wants to stage “mind games” in the Peoples Republic of China. The Company says that it acquired rights, from the Chinese government, to stage Chinese Chess, Poker and Mah Jong tournaments. How valuable are those rights? One promoter, who distributes faxed reports called “Stock Alerts,” thinks they make the Company a “Strong Buy,” with a price target of $5.00 a share – which is more than RTG Ventures paid to obtain those rights.

Why did the Chinese government generously give away these rights for free? Could it be that they are not as valuable as Stock Alerts suggests?

Be On Alert

Stock Alerts’ motivation probably can be summed up in one word – or five numbers – $15,000. That is how much Stock Alerts admits it received in cash from an unnamed “non-affiliated third party” for publishing and circulating its glowing report on RTG Ventures.

The Stock Alerts “profile” of RTG Ventures offers little more than the visions of sugar plums that are traditional fare this time of the year. In essence, it mirrors an October 24, 2003 press release issued by the Company, and offers no meaningful independent analysis of a prospective investment.

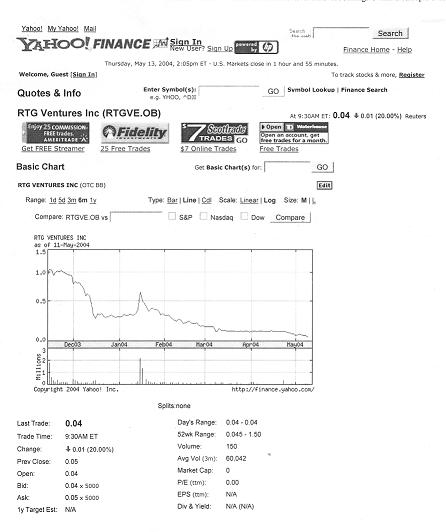

Stock Alerts characterizes the Company as a “Strong Buy,” and sets a target price for shares at $5.00, yet none of the information it provides would support that aggressive position. Indeed, RTG shares, which were trading at $1.04 when the Stock Alerts report was issued in mid-November 2003, had dipped to 58 cents by December 9, 2003.

The Stock Alerts profile regurgitated the scant information contained in the Forms 8-K filed by the Company – although it omitted all reference to the dismal financial history of MJWC. Rather than realistically assess the prospects of the Company – which still lacks funding and has provided no meaningful details of its business plan, Stock Alerts projected that RTG Ventures “will see significant revenues opportunities from gaming participation, sponsorship of events from Western brand owners leading up to the 2008 Olympics in Beijing and from database marketing.”

At least they got the year of the Olympics right. Not surprisingly, the promoter provides no basis for its revenue predictions.

The profile is riddled with non sequiturs, references to the Chinese population that do not logically translate into revenues for the Company. For example, Stock Alerts states that “RTG’s technology is capable of accommodating up to 200,000 simultaneous players in [games of skill, including Chinese Chess, Mah Jong, and Chinese Poker] concurrently.” Yet there is no suggestion, either in the promoter’s “report” or the public filings, that the Company owns or has the right to any proprietary technology. Just what technology is being referred to – and what are the Company’s rights?

Having made that broad statement about the capacity of the mystery technology, the report proceeds to declare that “these games are played daily by hundreds of millions of people in China and have significant revenue opportunities as the company exploits the growing disposable income and leisure spending of the worlds (sic) largest market.” Unfortunately, this “analysis” does not demonstrate why, or how, the Company is poised to take advantage of these broadly claimed demographics. Nor does it say how the Company would generate any revenues. Online gambling is not an option – it is not legal in China.

To support its view – of RTG Ventures as a strong buy – the promoter noted the Company’s alliances with Global Digital Cash Ltd. (which would provide a loyalty card for RTG customers) and MVI Now Ltd. (which would deliver video content to a group that includes mobile phone users with Internet access in China). It did not, however, provide any terms of those alliances, or any information that would allow investors to obtain further details about Global Digital Cash and MVI Now.

An October 13, 2003 press release from RTG Ventures announced the alliance with Global Digital Cash, but provided little additional information about the value of that relationship. According to the press release, Global Digital would issue a loyalty card to RGV Ventures’ customers, entitling each cardholder to discounts on current registration fees to RTGV’s skills games championships and various other services and merchandise.” Neither the registration fees, nor the services and merchandise, were enumerated.

The press release went on to explain that Global Digital, an Australian-based entity, provides a “non-cash system of monetary exchange” that allows people who do not have credit cards to shop on the Internet. It did not say how those individuals eventually pay for their purchases.

Unfortunately that could present problems for a public company, like RTG Ventures, which is seeking to generate revenues. Individuals who do not have credit cards may not be creditworthy, or may not have access to a credit facility. The potential Chinese market may consist of hundreds of millions of game players, but if they lack credit cards the Company would be hard put to collect revenues for its Internet games.

The alliance between RTG Ventures and MVI Now was first revealed in an October 8, 2003 press release. According to that announcement, RTG would use software provided by MVI NOW, a London-based streaming video company, to deliver “video content of Ethnic Chinese games of skill to mobile telephone users with Internet access within China and Chinese communities worldwide.” The Company said that this process would allow mobile phone users to receive coverage of Chinese Chess, Poker and Mah Jong Championships – although it did not indicate when RTG would begin to organize and run those games.

The October 8th press release also suggested that mobile phones offer a payment alternative for Chinese customers. “Mobile phone payment systems are very popular with Chinese Internet users,” according to Linda Perry, Chief Executive Officer of RTG Ventures, Inc. She went on to say that “Consumers are more willing to pay for services this way rather than through credit cards. Ms. Perry noted that “far fewer Chinese have credit cards than have mobile phones.” She did not, however, explain how RTG Ventures would capitalize on this payment device.

While these strategic alliances are evidence of some activity, there is no indication that RTG Ventures is ready to stage any games. And, despite a litany of statistics in the Stock Alerts report – 400 million television sets, 220 million mobile phones, and 48 million Internet connections in China – there is no sign that the Company will capture any significant portion of those markets – even if it does launch its games.

Similarly, Stock Alerts points out that China has “developed a middle class with high disposable income,” but offers no basis for connecting that fact – which it does not support with any study or verifiable statistic – to the Company. Assuming that such disposable income does exist, and that the populace hungers for gaming activities, why should investors conclude that the Company will benefit? If the “exclusive rights” to these games have such considerable value, why did the government give them away for free?

Stock Alerts does not address such questions, instead reiterating the presumed value of planned gaming rights, which include: the Chinese Chess Championship until 2005 and Mah Jong and Poker rights until 2008.

The Stock Alerts profile contains little of substance to support this puffery. Although it presents only vague business plans, and no financial details, its urges readers to invest in RTG – citing China’s 1.2 billion population, its growing middle class, and gaming industry projections of $6 billion in revenues for 2004.

Show Us the Money

The Stock Alerts profile can be dismissed for what it is – a paid advertisement. More troubling is the Company’s continued failure to provide current financial information. RTG Ventures has not filed any quarterly or annual financial reports since May 26, 2003, when it filed a Form 10-Q for the quarter ended February 28, 2003. On August 27, 2003 the Company changed its fiscal year from May 31st to August 31st, and promised to filed a quarterly report on Form 10-Q by October 15, 2003.

No report was filed then, or at any time since. On December 5, 2003 the OTC Bulletin Board changed the Company’s symbol from RTGV to RTGVE, indicating that its shares will no longer by listed on the OTC Bulletin Board if current financial statements are not filed by January 4, 2003. RTG Ventures now says that it expects to file a Form 10-K Annual Report by December 15, 2003.

In the absence of audited financial information, investors are forced to rely upon paid promoters like Stock Alerts, and press releases issued by the Company, none of which provide a complete picture of the state of operations. What is the status of the Company’s business plan? A September 30, 2003 press release stated that two representatives of the Company, its Chairman, Brian Wolfson, and CEO, Linda Perry, planned to visit China to meet with government officials. No results of those meetings have been disclosed to the public.

That same press release said that the Company was planning a shareholders’ meeting for November 20, 2003 in New York City, and intended to change the Company’s name to Far East Challenges. Subsequent press releases do not indicate whether the shareholders’ meeting was scheduled or held, and public records reflect no name change for RTG Ventures. Have those plans changed? Perhaps. An October 21st press release states that the Company now has offices in London and Beijing, and will operate as Far East Challenges in China and Europe. Another question is left unanswered by that press release; how is the Company paying the rent for all of its offices?

Two other recent announcements by the Company are worth noting. The first, an October 27th press release, discloses that an individual named Raymond Keene has been appointed “Games Consultant” to the Company. Mr. Keene is described as an international authority on chess and “mind games” who serves as chess correspondent for the London Times and International Herald Tribune.

While Mr. Keene’s credentials seem noteworthy, there could be some cause for concern. Mr. Keene apparently was involved with a London based company called Brain Games Network plc, which staged “mind games,” including Chinese Chess tournaments, and became embroiled in controversy and allegations of misconduct. In some regards, the RTG Ventures game plan echoes that of Brain Games, since it focuses on staging tournaments and “mind games.” Why does the Company believe that this business will work this time around – half way around the globe?

If the Company’s plans materialize, Mr. Keene should have an opportunity to test those “mind games” soon. On November 6, 2003, the Company announced that it was working with the Chinese Sports Ministry to stage the first “Beijing MindFest” convention in China. The Company contemplates a three day event in May 2004, featuring board and brain game masters from around the world.

No word on how the Company plans to finance the project.

Considering all of these questions, and the absence of audited financial statements, investors have little to go on, aside from the hype. Despite the enthusiasm of the paid tout, there is little basis for predicting a profitable future for RTG Ventures at this point. Investors may want to exercise restraint.

Now there’s a mind game well worth playing.

This is really the 3rd blog, of your site I read through.

And yet I actually enjoy this particular 1, “Brain Games and a Chinese Puzzle” the most.

Cya ,Silvia